Ifrs 16 Solvency Ii

Solvency II directive tries to deepen the insurance market improve the international competitiveness of EU insurers and setup further better regulation in the EU insurance market. Under NZ IFRS 16 Leases are excluded from exposure class 11 of Table 1 the Asset Concentration Risk Charge set out in paragraph 90 and from Table 3.

Leases Een Gids Voor Ifrs 16 Deloitte Belgium Audit Services Ifrs International Financial Reporting Standards Leases

Solvency II is a directive contained in the European Union legislation whose effective date was on the first day of 2016.

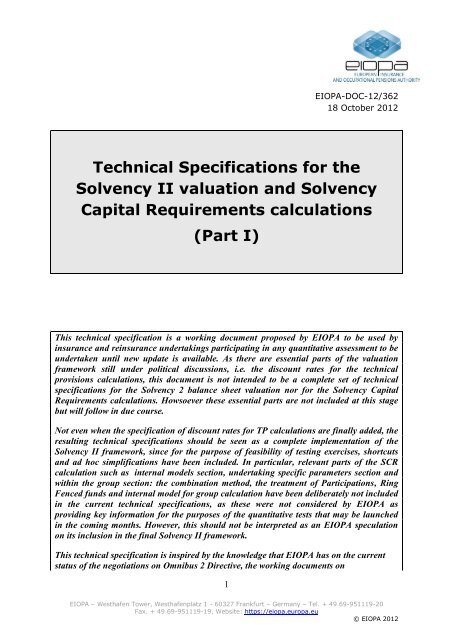

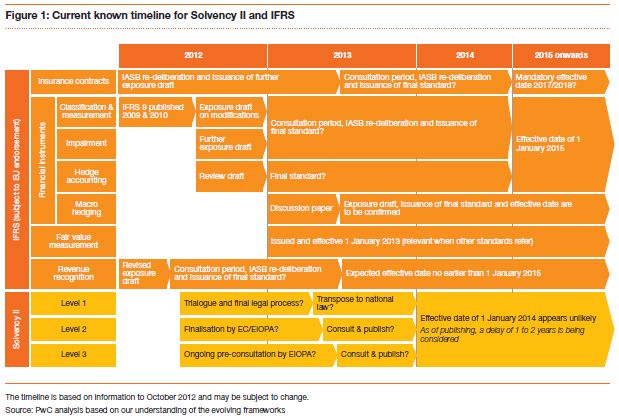

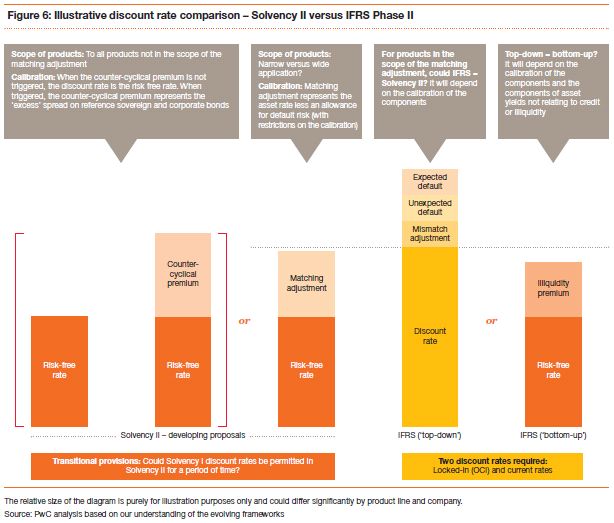

Ifrs 16 solvency ii. Both Solvency II and IFRS 17 base the measurement of insurance contract liabilities on the concepts of a probability-weighted estimate of the future cash flows the time value of money and an additional allowance for risk. Discount rate Top down or bottom up Current and locked-in for OCI purposes Likely to be prescribed for most non-life insurers It is unclear how the Solvency II discount rate will compare to the principle based approach in IFRS. IFRS 17 and Solvency II by comparing the text of these two regimes and assessing the impact of any differences. In IFRS there is implicit deferral of acquisition expenses. For Solvency II reporting we are waiting for a decision from EIOPA on whether or not to adopt the new IFRS 16 measurement basis. In planning to implement IFRS Phase II initial considerations include.

16 4 of the Delegated Regulation EU 201555 and therewith can be assumed to be consistent with Art. C Subsequently the paperappendix presents the findings of EFRAG outreach activities to assess whether and to what extent insurers are able to use Solvency II calculations and systems when implementing IFRS 17. Consistency of IFSRs with Article 75 IAS 19 as emended in 2011 Employee benefits see for example IAS 2 Inventories and IAS 16 Property Plant and Equipment IAS 19 REVISED 2011. LTGA versus Solvency II Preparatory Phase Topic LTGA Solvency II Preparatory Phase Valuation Assets and other liabilities V14. As ifrs 16 is nothing else but a balance sheet extension the value of rou assets is based on the discounted future payments the lessee doesnt participate on the value changes of the leased assets and to avoid double-counting of risks at lessor and lessee we believe that the rou assets should be subject to the interest rate shock submodule. Thanks to the transparent standard setting process at the IASB the IFRS requirements are known to a significant extent.

Financial Times 7 February 2016. Share this Download as PDF. We would like to confirm that the valuation of lease items according to IFRS 16 should be the same in SII balance sheet not only at first recognition but also for subsequent reporting periods especially for the property plant and equipment that will be depreciated in IFRS balance sheet. IFRS 16 Solvency Ratio. 75 of the SII DirectiveA market-consistent valuation in accordance with Art. This is under the working assumptions that IFRS Phase II is mandatory from 1 January 2018 Solvency II is effective from 1 January 2016 and that during the gap period the existing approach to IFRS reporting for insurance contracts is maintained.

The new right-of-use assets and lease liabilities are not explicitly addressed in the current RBNZ insurance sector Solvency Standards2 4. NZ IFRS 16 will result in new assets and liabilities on the balance sheet for lease contracts. Solvency II is a set of regulatory requirements containing fundamental capital adequacy regime for insurance undertakings operate across European Union. Solvency II comes at you from many angles but CCH Tagetik Solvency II pre-packaged solution has the templates calculations reports and dashboards you need to accelerate Pillar I Pillar II and Pillar III compliance. IFRS 17 reporting will also be more transparent due to stringent disclosure requirements. In IFRS 17.

This solvency standardapplies in accordance with this Section to every licensed. Seeks your views on some proposed changes to the insurance sector Solvency. IFRS 17 and Solvency II by comparing the text of these two regimes and assessing the impact of any differences. So you can meet all its qualitative quantitative and disclosure requirements with ease our solution reduces risk and puts. IFRS-proofing the Solvency II infrastructure analyses the design structure of the Solvency II infrastructure against the IFRS requirements delivering the elements that could be turned into the IFRS implementation blueprint. Solvency II Ratios Move into the Spotlight.

E paragraph 128 applies from 1 January 2019. EU watchdog lauds insurer moves to adapt business models. The law seeks to codify and harmonize the regulation guiding insurance service within the EU. IFRS16 New standard could make you Insolvent Page 2 Willis Towers Watson Alliance Partner Solvency example Consider an entity at 31 December 2018 with 20m assets 14m liabilities and a minimum required solvency capital of 4m. What is solvency II. UK fears that rules harm insurance competition.

The Guidelines relate to Article 75 of Directive 2009138EC of the European Parliament and of the Council hereinafter Solvency II Directive2 and to Articles 7 to 16 of Commission Delegated Regulation EU 2015353. Upon adoption of IFRS 16 the business will recognise right-to-use assets under lease contracts as a gross up of assets and liabilities. Solvency II specifies the risk-free rate as well as liquidity. No equivalent concept in Solvency II. IFRS 17 on the other hand aims to apply uniform accounting standards for all types of insurance and reinsurance contracts and also to reduce the gap between standards followed in insurance. Axa chief calls for stability after Solvency II introduction.

Financial Times 25 February 2016. The recognition and valuation of balance sheet items according to IFRS 16 Leases fall under the requirements of Art. C Subsequently the appendix presents the findings of EFRAG outreach activities to assess whether and to what extent insurers are able to use Solvency II. IFRS 17 and Solvency II EFRAG Board meeting 14 January 2020 Paper 06-02B Page 3 of 21 16 In assessing the potential extent of synergies EFRAG has used two sources of. Reuters 23 May 2016. These Guidelines are addressed to supervisory authorities under the Solvency II Directive.

75 needs to be ensured. Share-based payment IFRS 2 Leases IFRS 16 Statement of cash flows IAS 7 Non current assets held for sale and discontinued operations IFRS 5 The effects of foreign exchange IAS 21 Operating segments IFRS 8 Standards by year end date. Fitch Ratings 9 May 2016.

Technical Specifications For The Solvency Ii Eiopa Europa

Finalyse 2020 Solvency Ii Review Technical Provisions And Scr

Bringing Together Ifrs And Solvency Ii November 2012 Accounting And Audit Malta

Bringing Together Ifrs And Solvency Ii November 2012 Accounting And Audit Malta

Finalyse 2020 Solvency Ii Review Technical Provisions And Scr

Post a Comment for "Ifrs 16 Solvency Ii"